omaha nebraska sales tax rate 2021

This is the total of state county and city sales tax rates. Groceries are exempt from the Omaha and Nebraska state sales taxes.

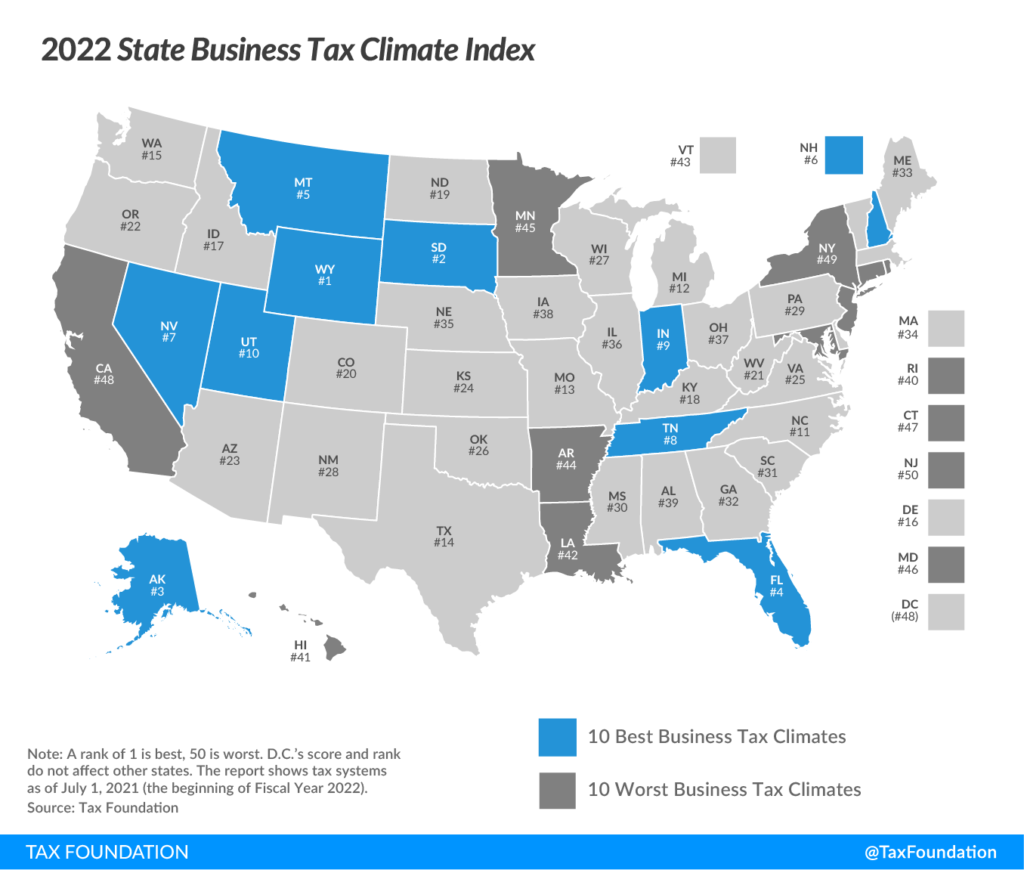

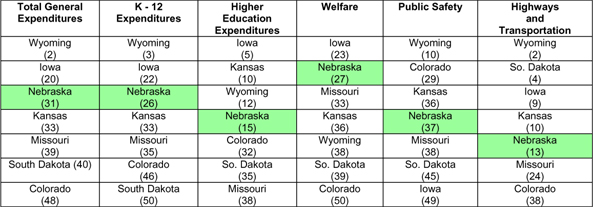

Nebraska Drops To 35th In National Tax Ranking

The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax.

. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. You can find more tax rates and. Local Sales and Use Tax Rates Effective April 1 2021.

2021 Nebraska State Sales Tax Rates The list below details the localities in Nebraska with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. The Nebraska sales tax rate is currently 55. 31 rows The state sales tax rate in Nebraska is 5500.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. The Nebraska sales tax rate is currently. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

There is no applicable county tax or special. The base state sales tax rate in Nebraska is 55. The Nebraska sales tax rate is currently.

With local taxes the total sales tax rate is between 5500 and 8000. Tax rates provided by Avalara are updated monthly. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha.

Average Sales Tax With Local. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. This is the total of state county and city sales tax rates.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. This is the total of state county and city sales tax rates. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05.

The minimum combined 2022 sales tax rate for Ord Nebraska is 75. The minimum combined 2022 sales tax rate for Gretna Nebraska is. Nebraska has recent rate changes Thu Jul 01.

There is no applicable county tax or special tax. Omaha collects a 15 local sales. The local sales tax rate in Omaha Texas is 825 as of April 2022.

FIPS Code Federal Information Processing Standard code used by Streamlined Sales Tax City Local Total Rate. Changes in Local Sales and Use Tax Rates Effective January 1 2021. The Nebraska state sales and use tax rate is 55 055.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Look up 2022 sales tax rates for Nemaha County Nebraska.

The minimum combined 2022 sales tax rate for Columbus Nebraska is. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. Exemptions to the Nebraska sales tax will vary by.

Find your Nebraska combined state. See the County Sales and Use Tax Rates section at the.

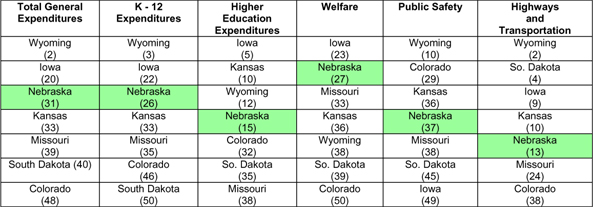

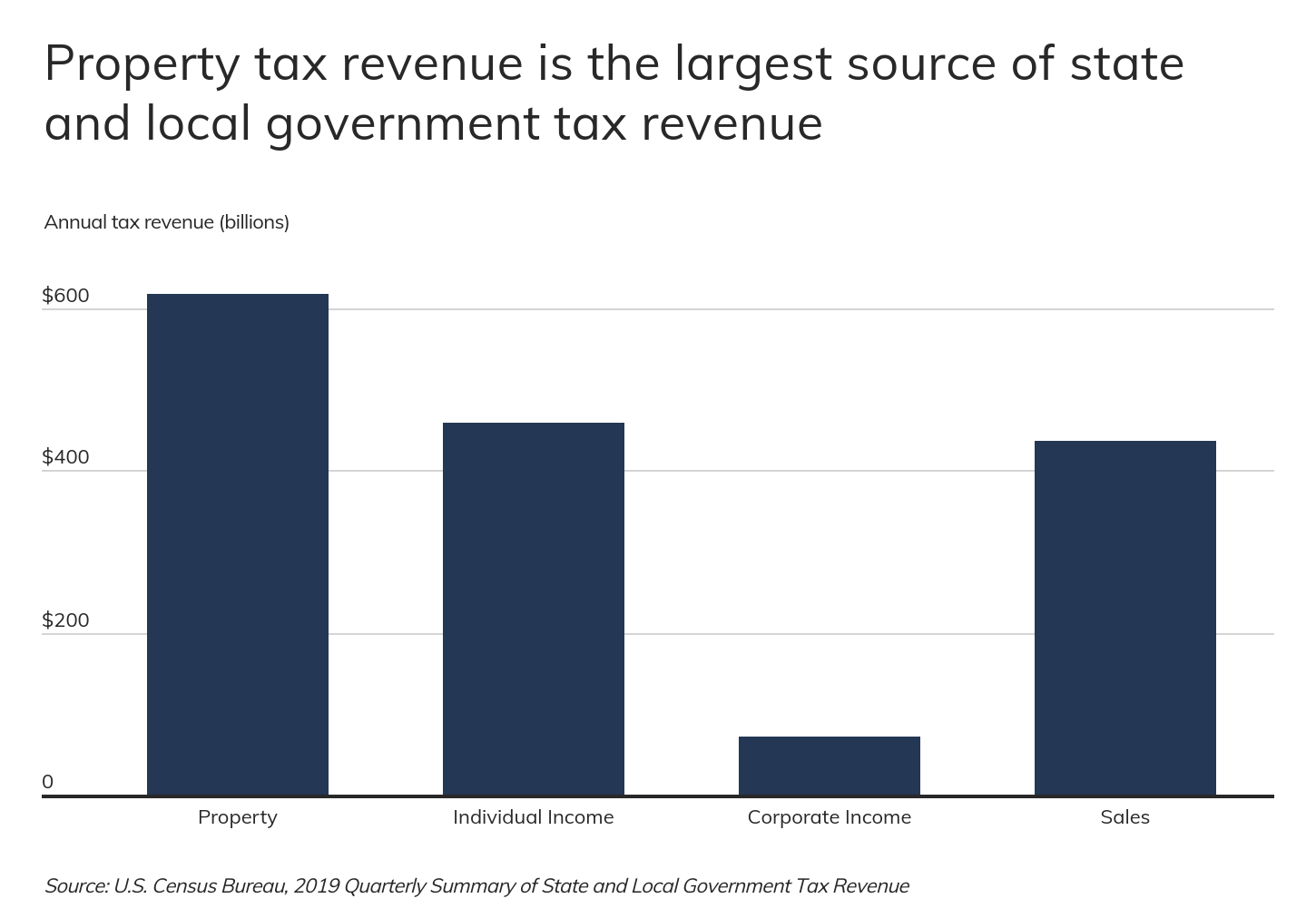

Taxes And Spending In Nebraska

The Most And Least Tax Friendly Major Cities In America

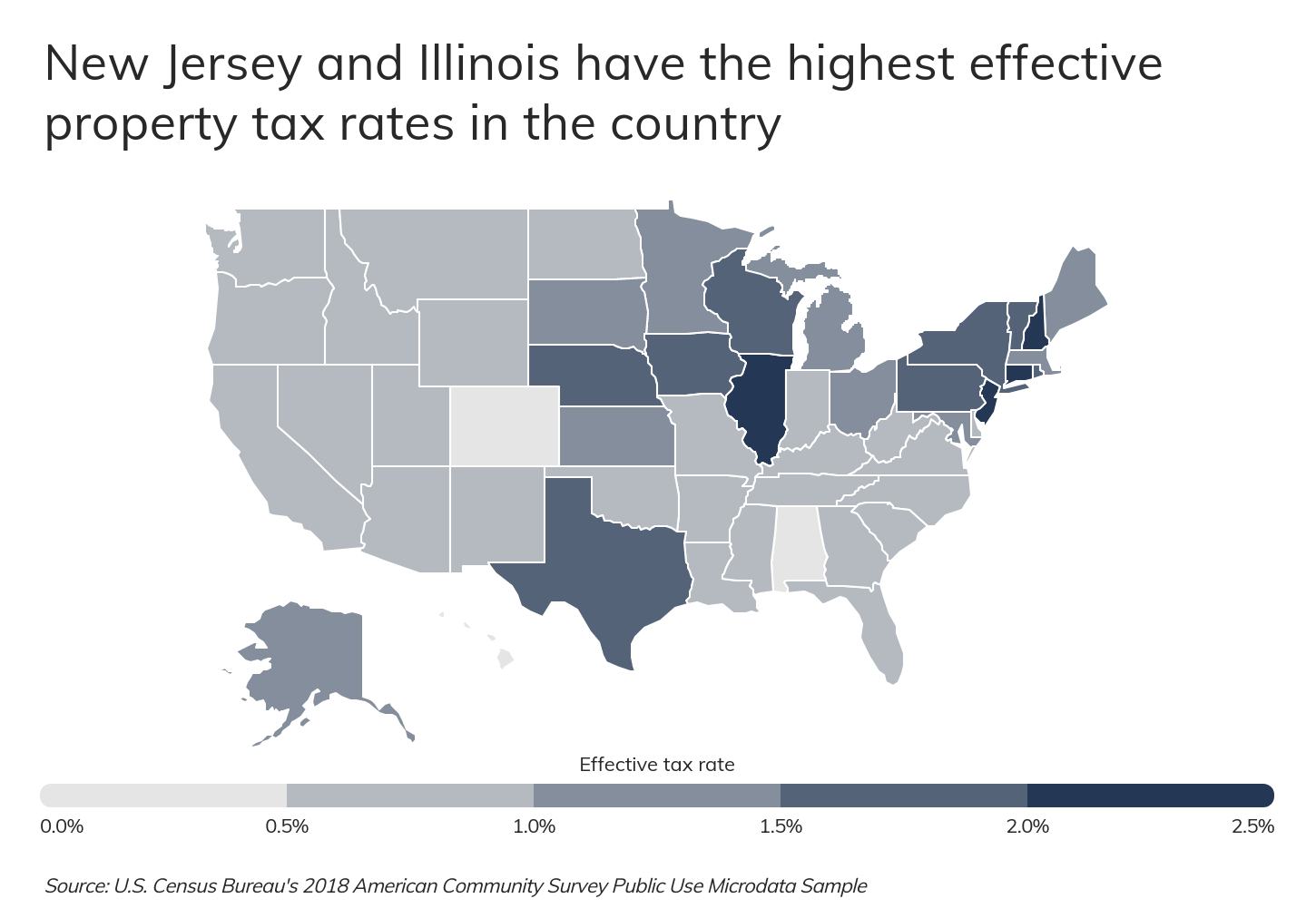

New Ag Census Shows Disparities In Property Taxes By State

Nebraska Sales Tax Small Business Guide Truic

How High Are Cell Phone Taxes In Your State Tax Foundation

Sales Taxes In The United States Wikiwand

Income Tax News Research And Analysis The Conversation Page 1

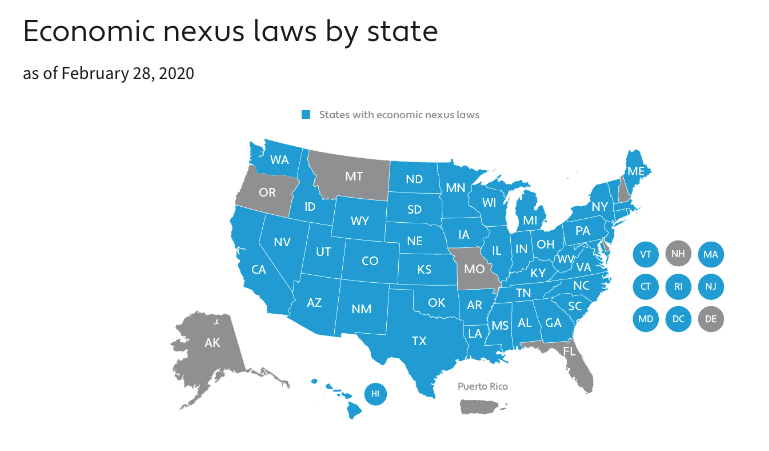

Amazon Sales Tax For Sellers In 2021

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

Which Cities And States Have The Highest Sales Tax Rates Taxjar

The Cities With The Highest And Lowest Property Taxes Real Estate Omaha Com

Sales Taxes In The United States Wikiwand

Nebraska Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates